What our donors say?

What our scholars say?

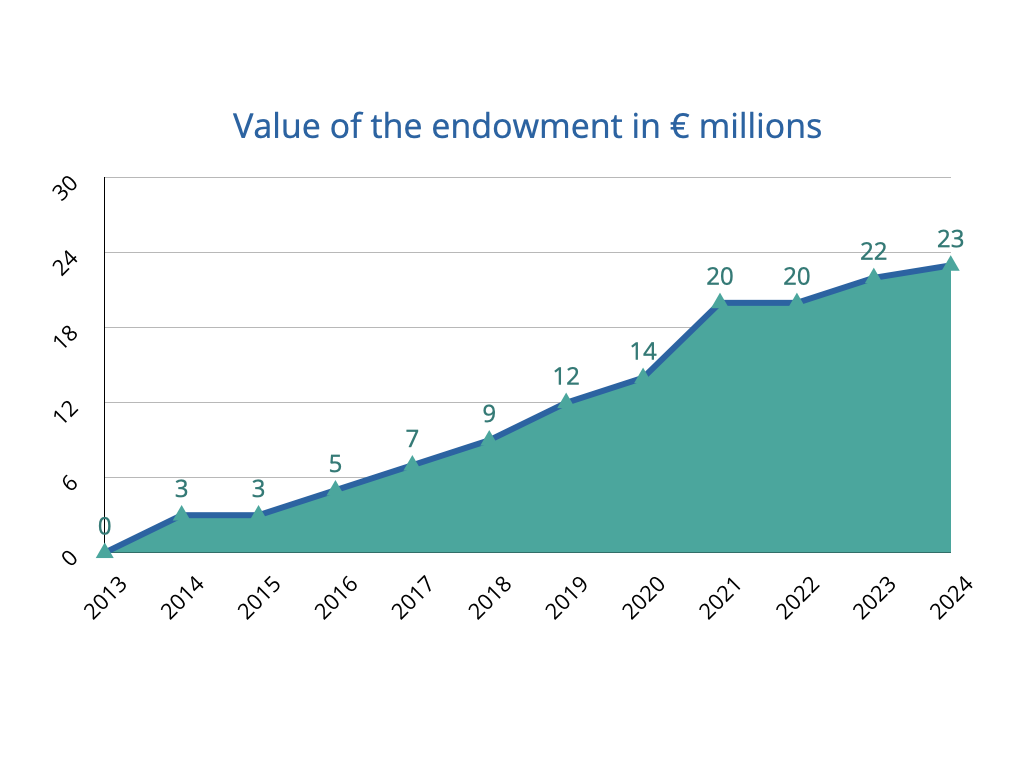

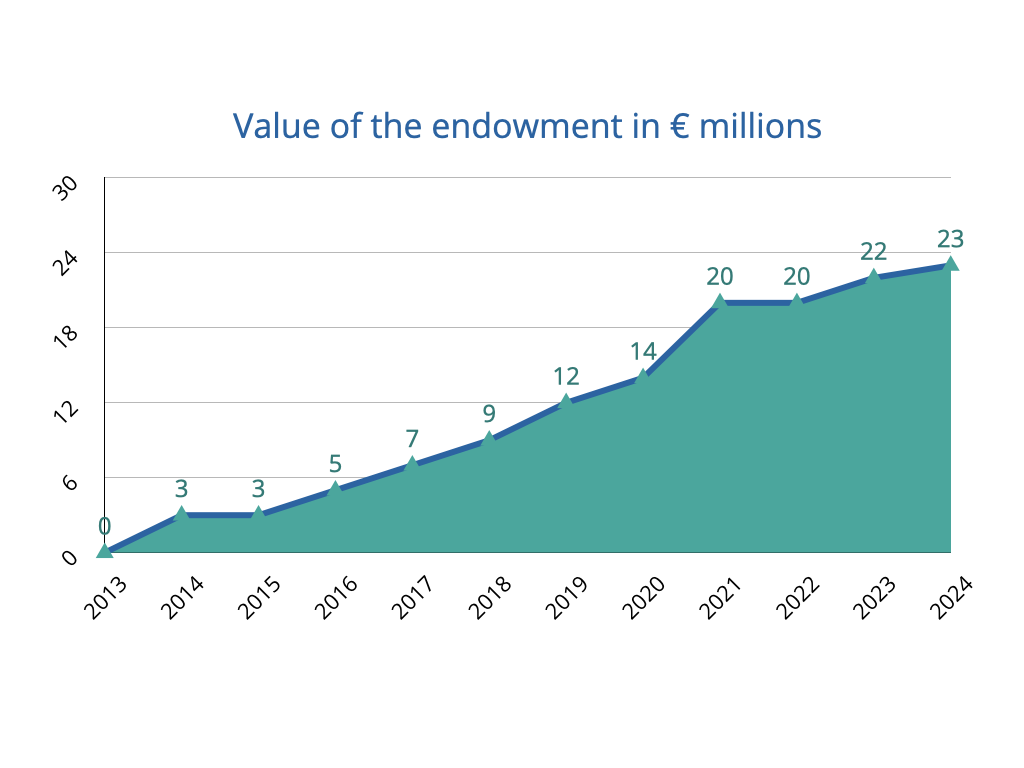

Annualised investment performance is 7.1% since the UWC Mostar endowment started investing in 1 November 2016.

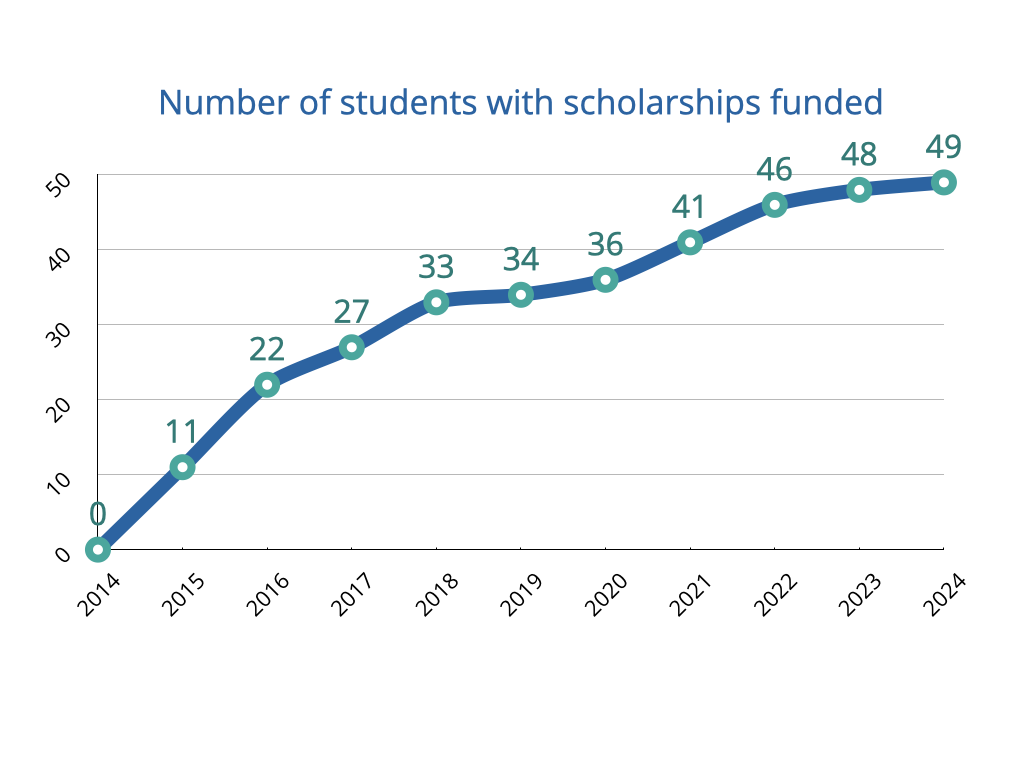

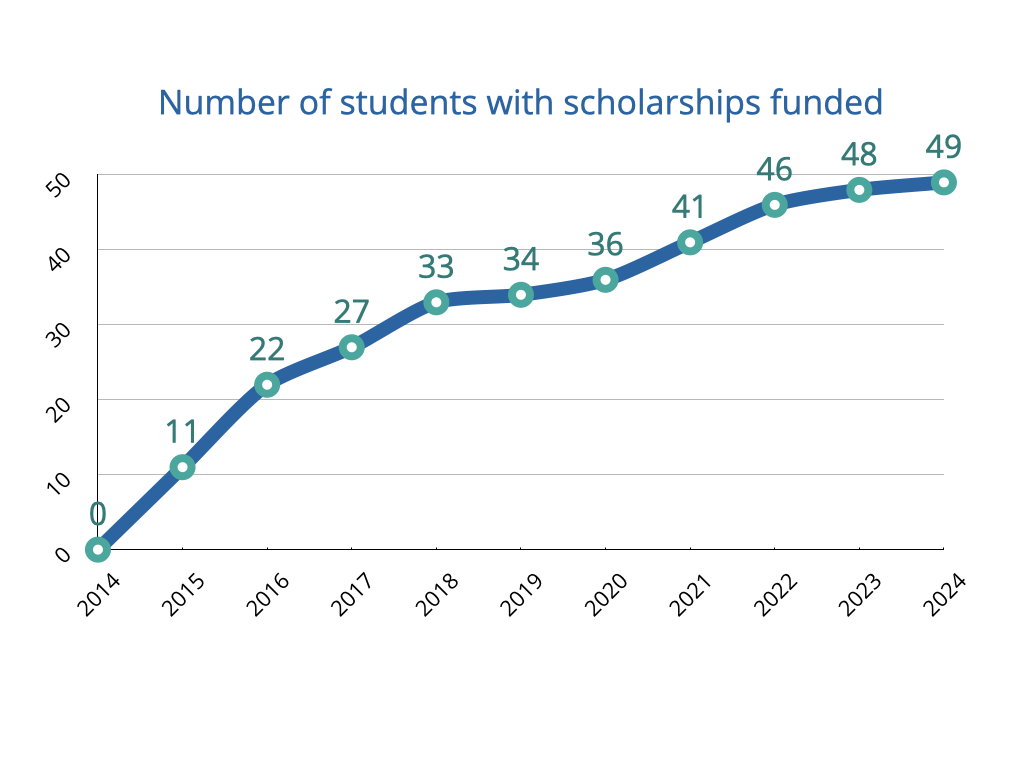

Scholarships have been increasing year on year with the growth of the endowment fund.

What our donors say?

What our scholars say?

The target size for the Endowment Fund is €30M, ensuring permanent funding for operating expenditure for UWC Mostar.

After the completion of the initial “pilot” period of UWC Mostar which was significantly supported by governmental institutions, a long-term financing model needed to be developed to secure the continuation of the College.

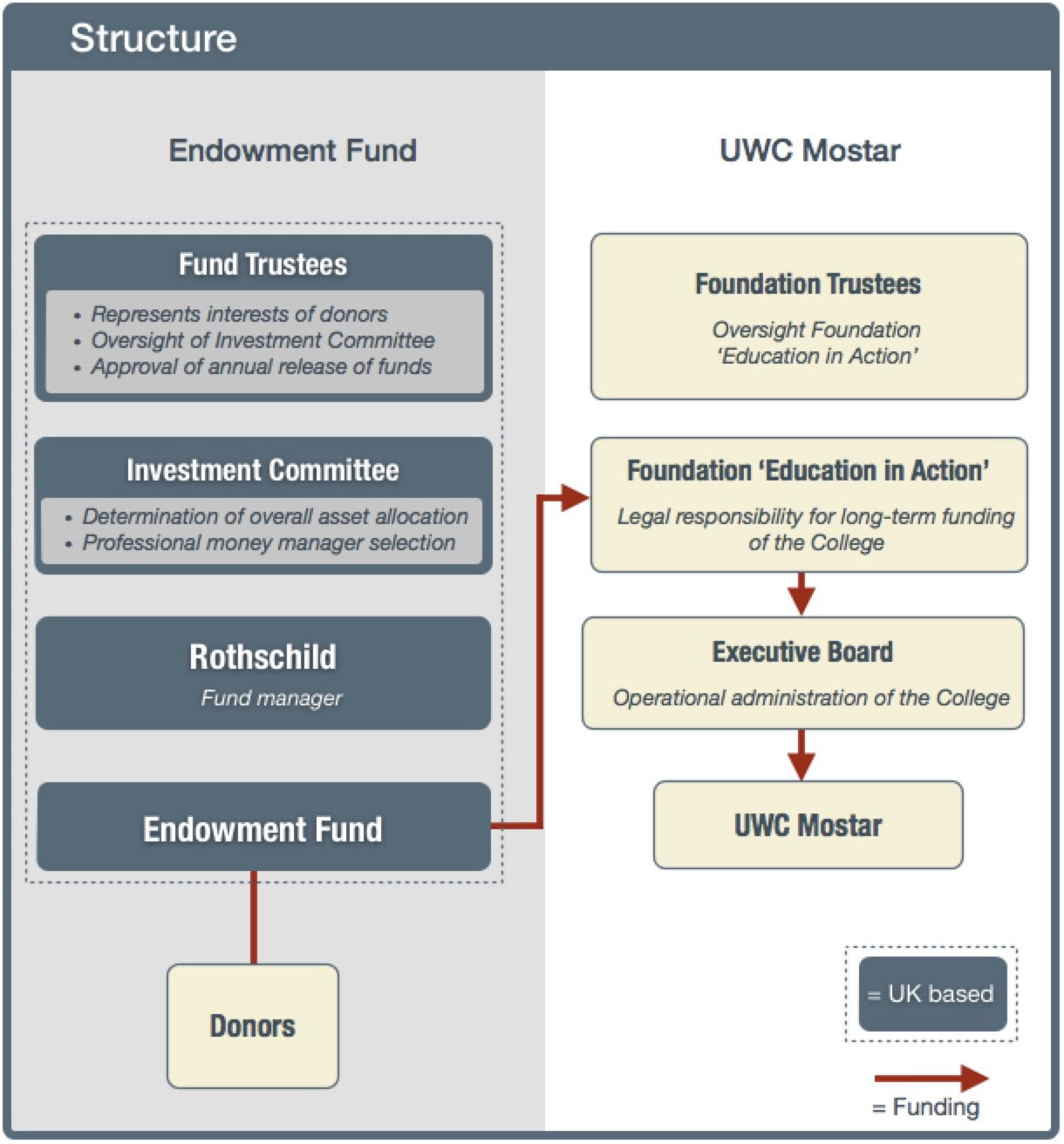

In 2013, Bridge to the Future, an UK endowment fund, was set up as a long-term solution to provide scholarships to UWC Mostar students. Bridge to the Future has established governance structures that ensure that the best-in-class stewardship of donor capital is put in place:

The College has an annual budget of approximately €3 million,

with places for 200 students.

The cost of sponsoring one student a year is €15k. One endowment ‘costs’ €300k assuming 5% average annual return to provide funding for a scholarship every year into perpetuity.

Following the first 10 years of fundraising efforts, in excess of €20 million endowment funds have been secured. The overall aim is to raise a total of €30 million of endowment funds, ensuring permanent funding for 50% of the operating expenditure of UWC Mostar.

Scholarships have been increasing year on year with the growth of the endowment fund.

The number of scholarships is dependent on the return on the investments and is determined each year by the Board of Trustees.

The Endowment Fund will be founded on the promise that donors will be able to “to see their money working”. It's our goal to be excellent stewards of donor capital.

The core principles:

A strong governance structure for the Endowment Fund has been put in place to ensure that the capital donated to the Fund is managed in line with the objectives of the donors.

The Endowment has been set up in the UK, incorporated under UK Law and registered with the Charity Commission

The Endowment will have two principal bodies, namely the Trustees and the Investment Committee:

Both the Endowment and UWC Mostar will have their performance monitored against targets, with ongoing communication of performance to donors.

Both the Endowment and UWC Mostar will have targets in place

Risks will be mitigated by proactive planning and controls.

In the long term, conflict in the region might return